Governance

Customer Protection Principles

The Company shall ensure that all employees:

- Use respectful language, maintain decorum and are respectful of social and cultural sensitives.

- Do not Use threatening or abusive language.

- Do not use coercion of any sort to make recovery of loans and take recovery only at a centrally designated place. An employee can take recovery at the place of residence or work of the customer only if the customer fails to appear at the central designated place on two or more successive occasions

- Do not intimidate or humiliate verbally or physically.

- Do not persistently call the borrower and/ or do not call the borrower before 9:00 a.m. and after 6:00 p.m.

- Do not harass relatives, friends, or co-workers of the borrower.

- Do not publishing the name of borrowers

- Do not use or give threat of use of violence or other similar means to harm the borrower or borrower’s family/ assets/ reputation

- Do not mislead the borrower about the extent of the debt or the consequences of non-repayment.

Board Approve policy Application for loans and their processing

Board Approve Loan appraisal policy as per RBI Guidelines

Minimum Period of Moratorium

Sharing with client for Disbursement of loans including changes in terms and conditions well in advance

Disclosures in loan agreement / loan card

DIGITAL LENDING PLATFORM

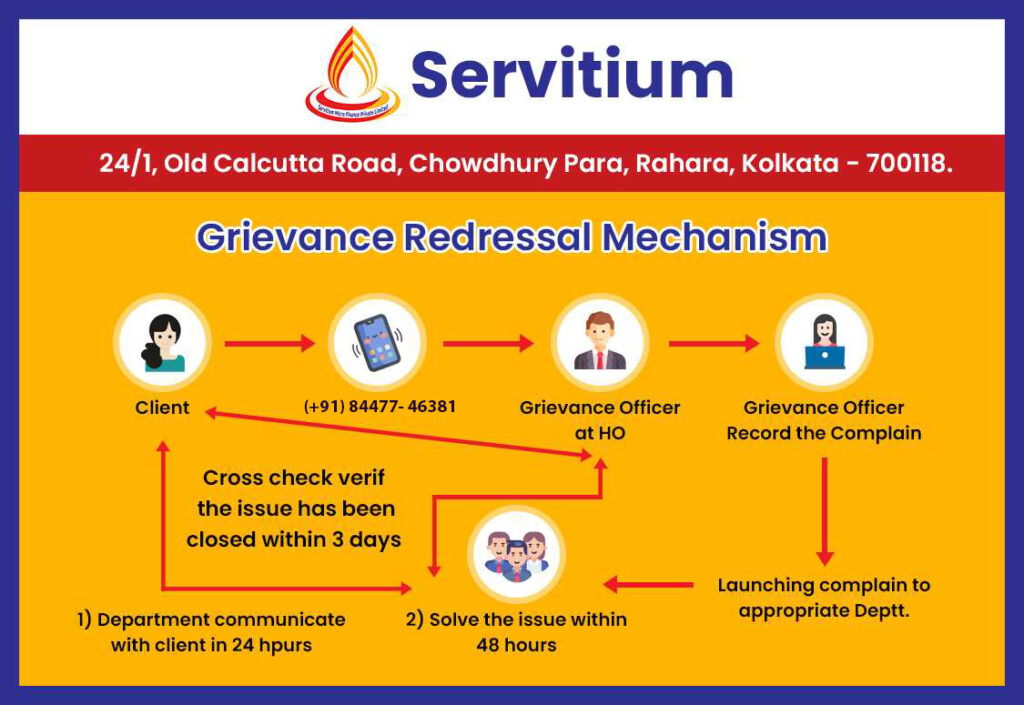

Client Grievance Redressal

There are three formal stages in which any grievance can be redressed. At the Company, we want to make sure that customers get only the very best of service from us – service which our valued member deserves.

STEP: 1 Members may contact our branches or write to the Branch Manager explaining the details of their issues. Our Branch Manager will be glad to assist you.

STEP: 2 If you do not receive a response within 10 days from the channels under STEP:1, or, if you are not satisfied with the response received, you can escalate your complain to our Help Desk Executive at our Corporate Office 8447746381 (from 10.00 AM to 05:00 PM except Saturday, Sunday and other Holidays)

STEP: 3 If you are not satisfied with the response that you receive from the Branch level or channels under STEP 2, or if you do not hear from us in 10 days, you may contact the Office of the Chief Nodal Officer for a speedy investigation and fair resolution of your problem. Please quote the reference number provided to you in your earlier interaction with the Company, along with your account / loan number to help us understand and address your concern.

You may write to: Mr. Pijush Saha Nodal Officer Corporate Office: Servitium Micro Finance Private Limited. 24/1, Old Calcutta Road, Chowdhury Para, Rahara Kolkata – 700 118 Toll Free – 8447746381

If you are not satisfied with the response received from Chief Nodal Officer or do not receive any response within a period of one month, please contact: MFIN toll free help line: 1800 270 0317

If you are not satisfied with the response received from any of the above or do not receive a response from MFIN in 15 days, please contact: The General Manager Reserve Bank of India Department of Non-Banking Supervision 5th Floor, 15, N. S. Road, Kolkata-700001

- The Company has installed complaints/suggestion box at all our branches at prominent places to receive written complaints.

- The Company has the Head Office address with Telephone number printed in all passbooks.

- During Group Training, discussions is made with our customers about the Grievance Redressed System and its benefits.

- The Company assures that the Customer will be treated fairly despite the grievance being lodged.

Whistle Blower Policy & Sexual Harassment

Effective whistle-blower policy needs to be implemented to discourage malpractices, encourage openness, promote transparency, strengthen the risk management systems & help protect the reputation of Seba Rahara. This policy lays down the process for raising a ‘protected disclosure’, the safeguards the individual who would raise the alarm. In all instances, Seba Rahara retains the right to determine when circumstances require an investigation and the appropriate investigative process to be employed.

Servitium will use best efforts to protect whistle-blowers against any counter complaint made by the subject / other employees. The organization will keep the whistle-blower’s identity confidential, unless:

- The individual agrees to be identified;

- Identification is necessary to allow officials to investigate or respond to the report;

- Identification is required by law; or

- The individual accused of compliance violations is entitled to the information as a matter of legal right in disciplinary proceedings.

Board Approved loan policy

To consider noting of the approval given by Board of Directors through circulation the policy of revised house hold income cap, indebtedness and all other guidelines for Microfinance loans as directed by RBI vide circular no RBI/DOR/2021-22/89 DoR.FIN.REC.95/03.10.038/2021-22 dated 14.03.2022

Household income:

Annual household income Rs. 3.00 Lakhs. Limit on the outflows on account of repayment including principal & interest of monthly loan obligations of a household as 50% of the monthly household income. The computation of loan repayment obligations shall take into account all outstanding loans (collateral-free microfinance loans as well as any other type of collateralized loans) of the household.

Income Assessment

| Particulars | Amount (In Rs.) |

|---|---|

| Maximum monthly income of a household…. (A) | 25,000/- |

| Less :Maximum expenses ………………. | |

| Food | B |

| Education | C |

| Medical | D |

| Electricity | E |

| Transportation | F |

| Total Expenses (B+C+D+E+F) should be maximum (G) | 12,500/- |

| Maximum Repayment obligation (A-G) | 12,500 |

1. Loan Pricing

| Parameters | Estimated % |

|---|---|

| Loan Processing Fees | 1.50% |

| Rate of Interest | 27.00% |